We make selling your home easy

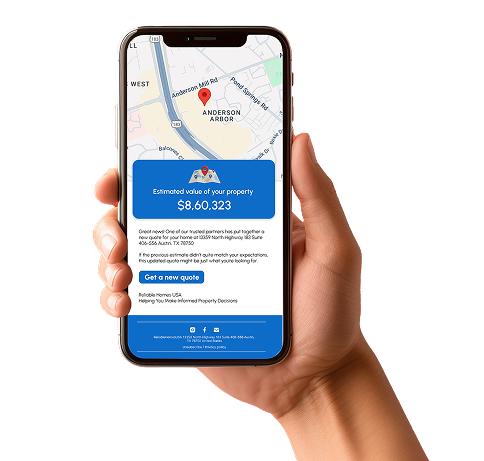

How much is my home worth?

Experience our simple and effortless process

designed for ease in just

3 Steps !

This helps us get the best possible offer from our investors for your home.

We'll use our local expert's evaluation and our pricing model to determine the best price for your home.

Receive a cash offer from our network of buyers.

Discover your home's value in mere minutes! Our efficient process provides you with an instant and accurate home valuation.

Our mission is simple, to provide unparalleled expertise, guidance, and support to our clients across their real estate journey.

Offering competitive rates that make quality accessible to all.

Ensuring transparent and compliant legal processes.

We have built a nationwide network of hundreds real estate cash buyers and investors